NY DTF CT-5.1 2024-2026 free printable template

Show details

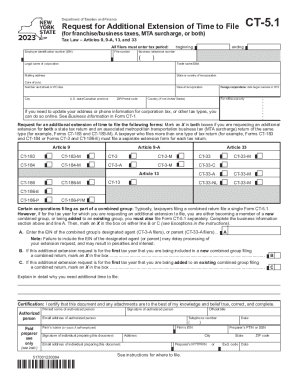

B C Explain in detail why you need additional time to file Certification I certify that this document and any attachments are to the best of my knowledge and belief true correct and complete. CT-5. 1 Department of Taxation and Finance Request for Additional Extension of Time to File for franchise/business taxes MTA surcharge or both Tax Law Articles 9 9-A 13 and 33 All filers must enter tax period Employer identification number EIN File number beginning ending Business telephone number...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny ct 5 form

Edit your form ct 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 5 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 5 form online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct 5 1 instructions form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-5.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dtf 5 1 form

How to fill out NY DTF CT-5.1

01

Obtain Form CT-5.1 from the New York State Department of Taxation and Finance website.

02

Fill in your business name and address at the top of the form.

03

Indicate your Employer Identification Number (EIN) or Social Security Number (SSN).

04

Provide the tax period for which you are requesting a credit or refund.

05

Complete the sections related to the specific credits or refunds you are applying for.

06

If applicable, attach any required documentation to support your claims.

07

Review your completed form for accuracy.

08

Sign and date the form at the bottom.

09

Submit the form via mail or electronically as instructed on the form.

Who needs NY DTF CT-5.1?

01

Businesses and individuals who have overpaid their taxes in New York and are seeking a credit or refund on specific tax obligations need to fill out NY DTF CT-5.1.

Fill

dtf 5 form

: Try Risk Free

People Also Ask about ny second extension

How do I get a NY state tax form?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

Does NY have state income tax form?

If you live in the state of New York or earn income within the state, it's likely you will have to pay New York income tax. And with that, comes completing and filing New York (NYS) tax forms. Read on to learn more about common NYS tax forms here!

What is a form CT-5?

Corporations subject to tax under Tax Law Articles 9-A, 13, and 33 may file Form CT-5 to request a six-month extension of time to file the appropriate tax return and MTA surcharge return. Do not use separate forms if you are requesting an extension to file both the franchise tax and MTA surcharge returns.

Who must file CT 3m?

All New York C corporations subject to tax under Tax Law Article 9-A must file using the following returns, as applicable: Form CT-3, General Business Corporation Franchise Tax Return. Form CT-3-A, General Business Corporation Combined Franchise Tax Return. Form CT-3-M, General Business Corporation MTA Surcharge Return.

Do I have to make a payment when I file an extension?

When you file Form 4868, the IRS Application for Automatic Extension of Time to File US Individual Income Tax Return, you can choose to pay the balance due amount in full, in part, or you can choose not to pay anything with your extension.

What is the CT tax extension form?

To request this extension, you must file Form CT-1127, Application for Extension of Time for Payment of Income Tax, with your timely filed Connecticut income tax return or extension. Purpose: Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return for individuals.

Can you pay NY franchise tax online?

ing to the NY Department of Taxation and Finance, corporations electing to electronically file their New York State tax return must pay online using direct debit or ACH Credit.

How do I pay my business sales tax in NY?

Log in to (or create) your Business Online Services account. Select the ≡ Services menu in the upper-left corner of your Account Summary homepage. Select Sales tax - file and pay, then select Sales tax web file from the expanded menu.

How do I file an extension for corporate taxes?

To request a filing extension, use the California Department of Tax and Fee Administration's (CDTFA) online services. You must have a CDTFA Online Services Username or User ID and Password. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

Can you pay NYS sales tax with a credit card?

Read the payment card disclaimer before making a payment. The New York State Department of Taxation and Finance ("DTF") is committed to providing its customers with the highest levels of service. Therefore, DTF permits payment of many types of tax liabilities with a credit or debit card, using the Internet.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dtf 5 for eSignature?

Once you are ready to share your form ct 5 1, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete new york second extension online?

pdfFiller has made it easy to fill out and sign nys dtf 5. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in form dtf 5?

With pdfFiller, it's easy to make changes. Open your nys dtf sales tax payment in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is NY DTF CT-5.1?

NY DTF CT-5.1 is a form used by New York State businesses to report their short-period income tax information for corporate taxpayers.

Who is required to file NY DTF CT-5.1?

Corporations that have a short tax year or are final return filers are required to complete and file NY DTF CT-5.1.

How to fill out NY DTF CT-5.1?

To fill out NY DTF CT-5.1, taxpayers must provide their basic business information, financial details for the short period, and any pertinent deductions or credits.

What is the purpose of NY DTF CT-5.1?

The purpose of NY DTF CT-5.1 is to facilitate the accurate reporting of income and tax liability for corporations that do not follow the standard tax year.

What information must be reported on NY DTF CT-5.1?

On NY DTF CT-5.1, taxpayers must report their gross income, deductions, tax credits, and the net tax calculation for the short period.

Fill out your NY DTF CT-51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Nys Dtf Ct is not the form you're looking for?Search for another form here.

Keywords relevant to ct five home page

Related to ct request

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.